TDS(tax deducted at Source) Rate chart For Assessment Year

"BY C.A Parth Dadawala" |

||||

A.Y. 2013-14

|

||||

Made To resident

|

Threshhold

|

Company,firm.Co-op Society,Local

authority

|

HUF , Individual

|

|

Section

|

Nature of payments

|

Rate in %

|

||

194A

|

10000

|

10

|

10

|

|

194A

|

Other Interest

|

5000

|

10

|

10

|

194B

|

Winning from Lotteries

|

10000

|

30

|

30

|

194BB

|

winning from Horse races

|

5000

|

30

|

30

|

194C

|

Payment to Contractors , Pay to Advt/Sub Contr , Payment to

Transportor

|

30000 (75000 in year)

|

2

|

1

|

194D

|

Insurance Commission

|

20000

|

10

|

10

|

194H

|

Commission/Brokerage

|

5000

|

10

|

10

|

194I

|

Rent-property

|

180000

|

10

|

10

|

194I

|

Rent-Plant / Machinery

|

180000

|

2

|

2

|

194J

|

Professional Fees

|

30000

|

10

|

10

|

Note -1

|

For Section 194C Rs. 30000 for single payment & Rs. 75000

for aggregate Payment during a financial year.

|

|||

Note -2

|

Payment Made to Transportor ,Tds is Not required If pan is

provided By the Transportor

|

|||

Note-3

|

Surcharge and Cess Is not applicable on tds from

01,04,2009 on any payment made to resident.

|

|||

Note-4

|

If pan not provided by the deductee then rate as per above

table or 20% which ever is higher is to be deducted.

|

|||

IT Corner : Ebookes , Computer tricks and tips , Softwares downloads , facebook tips , Working with PDF, excel.

Sunday, 21 October 2012

TDS Rate chart A.Y. 2013-14 (F.Y.2012-13)

Subscribe to:

Post Comments (Atom)

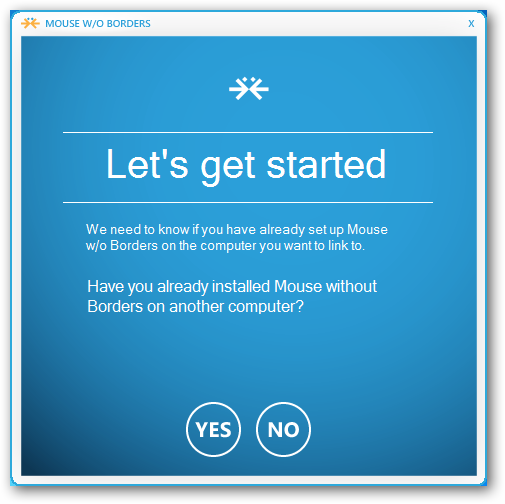

How to Use a Single Mouse and Keyboard Across Multiple Computers

If you’ve got multiple computers at your desk, you probably know that it’s a pain to use more than one keyboard and mouse. Here’s how to u...

Popular posts

-

If you’ve got multiple computers at your desk, you probably know that it’s a pain to use more than one keyboard and mouse. Here’s how to u...

-

How to Remove Password from excel sheet without knowing password. 1. Click here to download password remover macro/software file. 2....

-

Most of the people don't have Motherboard Utility Drivers. A Motherboard includes some parts like Video card driver, Audio card , E...

No comments:

Post a Comment